The Philanthropy Penalty: who is the world’s richest man when philanthropy becomes an investment

Jeff Bezos and Elon Musk have been playing musical chairs for the right to be named the richest man in the world. At the beginning of 2021, Musk claimed the top spot for just a few days, then Bezos, then again Musk, and again Bezos… So who deserves that musical throne? And could it be time to reexamine the game altogether?

In my opinion, our society imposes a «Philanthropy Penalty» on the wealthy who are involved in philanthropy. It is done in three ways.

First, wealth is viewed as net assets. If someone donates to philanthropy, everybody is interested in the wealth that remains. It seems natural that donations are deducted from net worth, making the generous appear poorer in the rankings. Should we then be surprised when even those who have already committed to give the majority of their wealth to philanthropy prefer to wait «till they die»?

Second, amounts donated to charity are valued at flat historical cost. Thus, the donations of those who started giving to charitable causes years ago look less and less generous as the years go by. No wonder then that many billionaires prefer not to rush with philanthropy.

Finally, we do not even have a word or a concept to admire contributors to the good. Our society of course has some appreciation for philanthropy, impact, influencing, disruptive innovation, game changing, leadership... However, none of these definitions (other than, potentially, the English term «impact» that remains unknown in quite a few other languages) are sufficiently compact or catchy to express success in life on a holistic level, especially compared to the word «wealth.» We then should not be surprised when many businesspeople apply their wealth in ways unrelated to philanthropy and impact investing.

Impact investing and chess: what do they have in common

Of course, there are people who do not worry about such things and donate from the heart without concern for public opinion. Meanwhile, the public often thinks that giving should be easy for billionaires because they have so much money. This perception is incorrect for a number of reasons. The vast majority of businesspeople’s wealth does not sit in their bank accounts but, rather, is comprised of their companies that need to develop, modernize, create new jobs, and incur other expenses. In addition, Stanford Professor Jeff Pfeffer and others have established that people who did not come into their money easily view money as an indication of their perceived competence and, with increase in income, they value money even more. Therefore, it would be natural for businesspeople to be apprehensive of the Philanthropy Penalty.

However, rankings could be viewed instead not as a calculation of «remaining money» but rather as a reflection of wealth as the skill to build a fortune and channel it to good causes, if only partially. A look at the Forbes World’s Billionaires List, having taken into account funds spent on philanthropy, would require a new approach to valuing philanthropy assets, introducing a concept of imputed return on philanthropy as well as defining societal values.

Philanthropy assets

Ethically, a contribution to philanthropy is the best impact investment one can make, even if technically it is not an «impact investment» or even an «investment». But it is not treated as an investment.

From the viewpoint of financial markets and rigorous financial accounting, money given away is always just that, money given away. However, financial market considerations do not always apply to billionaires as individuals. Money they have contributed to good causes could be valued as investments, not dismissed as a waste by being deducted from net worth.

Imputed return on philanthropy

If philanthropic contributions were to be considered investments, an imputed return would need to start accruing on them upon donation. To attribute today’s value to funds donated in the past, we could increase them, adjusting by any of the following factors: inflation, an average market rate of return, efficiency of implementing environmental or social changes or the «timely action factor» in terms of solving the world’s problems (given that stockpiled funds lose their value annually, in terms of their ability to save the planet).

A Ph.D. in economics from the IMF agrees, saying, «This approach is interesting and appropriate. In economics, it is referred to as «opportunity cost».

Impact Currency: why Forbes needs new impact investments ratings

Societal value

The Ancient Greeks highly valued their «kleos» (glory, the way we are remembered after death). In addition to wealth, let’s value something else. Let’s look at wealth without a Philanthropy Penalty, and let’s measure success in terms of something other than money: a modern-day equivalent of glory. For example, we could use the compact word «impact» to express such a measure.

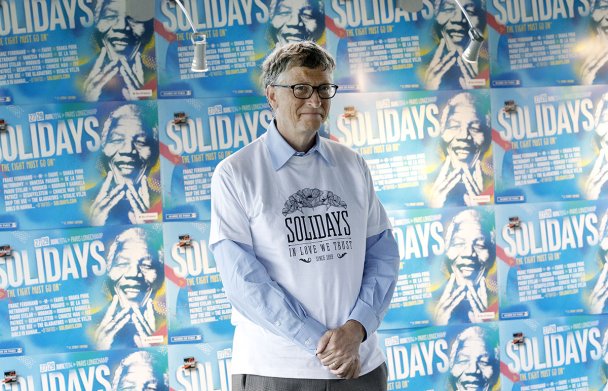

Let’s now look again at the Forbes World’s Billionaires List and its top pedestal after accounting for funds given to philanthropy. The math is simple. Bill Gates’ net worth is approximately $120 billion. So far, he has donated to charity over $45 bln. (of which about $30 bln. have already been distributed among non-profits). He started donating back in 1994. With the Philanthropy Penalty removed, Bill Gates appears to have donated to philanthropy $90-200 bln. in today’s money (depending on the exact dates of contributions and the rate of imputed return on philanthropy). This number, when added to his current net worth, raises his wealth to $210-320 billion. So, who wins the Bezos-Musk tug-of-war after eliminating the Philanthropy Penalty? Bill Gates!